We began Nov. 6 by asking: How can we increase the construction of affordable housing? Let’s zero in on one or two of the suggested tools identified earlier, that could help increase the supply of single-family, working-family housing.

Land. We spoke about two local nonprofits that concentrate on construction of affordable housing. Both Habitat for Humanity and Home Source mentioned the value of having buildable land readily available. Land acquisition is one of the larger lead-time and expenses they confront. For single-family housing, the land/building lot might represent 20 percent of the project budget. To keep the finished home affordable for a modest-income working family, the final purchase price of the home would ideally be in the $100K to $125K range. Call it a starter house, maybe 1,200 to 1,400 square feet. Better yet, think of it as a home.

This ready-to-build lot has several advantages. First, if you have skilled crews or subcontractors, you want to keep them with a steady stream of work. Otherwise, you might lose them to other developers with a larger or steadier book of business. High-priced subdivisions can pay a premium to attract such workers. If the land has unresolved legal issues with title or zoning, the preconstruction lead-time increases. That might require costly professional services to resolve. In addition, first-time homebuyers of modest means usually cannot qualify for a much larger mortgage in the present financial climate. So cost control matters.

In speaking with several representatives of Knoxville’s Habitat for Humanity, I gleaned that ready access to land could enable them to increase, and possibly even double, the number of homes they could build. That would raise the 20-25 houses per year up to as many as 50 units.

Home Source likewise asserts land availability could help their productivity. Lately, they have been concentrating more on multifamily units because in addition to lot scarcity, they are also experiencing a shortage of skilled laborers. Many trades workers left the construction field for other careers when the 2008 mortgage crash and recession hit. Like most economic issues, short supply generally increases price … and, at some point, those considerable labor costs can price a hoped-for affordable house out of the lower target range. More expensive subdivisions can more readily pass on higher labor costs in the sales price.

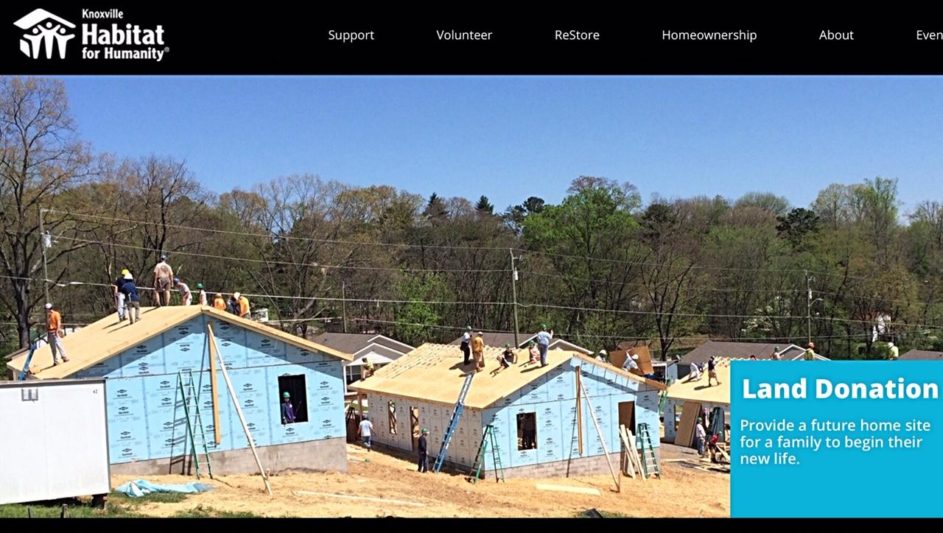

Habitat fortunately can better control construction labor costs through the use of volunteer labor to erect the houses. Businesses and various volunteer groups team up to build a house under skilled supervision.

In addition, there is a potential source of buildable land in East Knoxville. MPC reported in the 2009 Magnolia Corridor Study that there were some 130 vacant lots and over 100 vacant buildings near that corridor. They could be put back to work.

Finally, as mentioned in the earlier KnoxTNToday article, an additional housing advantage might be also gained by factory pre-fab walls that can be erected and joined more quickly by workers at the site. So, too, would pre-approved house-design plans, contributed by architect groups and homebuilder associations (that would only leave setback and siting requirements for individual project approval). Each such skill contribution could increase the number of lower-cost units made available.

Land Bank. That brings us back to the idea of a land bank. The city government or a nonprofit agency – which I choose to call “Legacy House” after Legacy Parks’ successful creation of new parks – could acquire land via purchase or donation and make such tracts available to worthy affordable-housing projects at little or no cost. Qualified builders could obtain building lots under a contractual promise to build and market a house for an agreed sales-price cap.

Of course, location, in addition to just price, matters to builders. Things like topography and need for clearing, good street access, available utilities (water, electric, sewer vs. septic, etc.) and general attractiveness of the block or neighborhood affect cost and salability.

Gifting. Community members and benefactors could help raise funds to keep a fair inventory of buildable tracts on hand. Not using the back 5 acres? Give it to the land bank. Or want to make a charitable devise in your will? Give a family a chance to get under their own roof. Whether it’s a cash gift or land, you would be helping to build a better, more-engaged community. Make the Legacy House gift tax-deductible and increase the chance of success. The entity could also apply for public and private grant funding.

Laws. Some jurisdictions, by ordinance, endow their Land Banks with power to acquire land by tax foreclosure, clear title and extinguish tax liens, hold the banked land tax free, and negotiate sales or grants based on acquirer’s conformity to community purposes (rather than price). Once a structure is built, the property returns to the tax rolls. As an incentive, there can even be a tax-sharing during the first year back on the tax rolls.

Education. Additionally, community organizations like the Urban League, Home Source and Habitat offer first-time homebuyers financial education on how to acquire, maintain and keep a house. These are important tools for the buyer’s long-term success.

Call to Action.To my former colleagues on City Council, isn’t it time to host a workshop or fact-finding legislative hearing on affordable housing? Find out what works in other jurisdictions. Just tinkering with multifamily zoning under Recode will not get you there.

Nick Della Volpe is an attorney and a former member of Knoxville City Council.