As technology evolves, we expect scammers to try to contact us by text, email, or social media, but “snail mail”? Yes, those scams are still common.

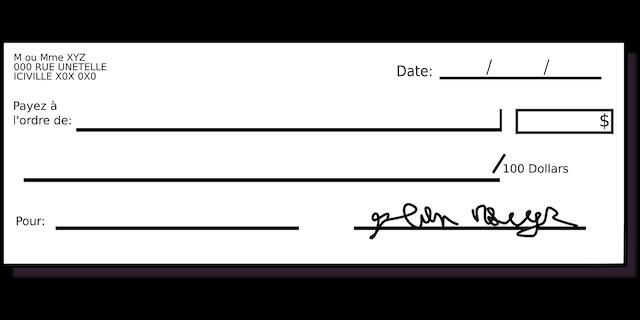

For instance, you may receive a check in the mail for $5 or $10, with instructions that sound simple: deposit it, and you’ll learn about a life insurance program that could pay up to $50,000.

Here’s another recent example. Targets of this scam receive a check under names like “Senior Check Benefits,” with promises of coverage for related expenses.

While these checks may appear harmless, the Better Business Bureau (BBB) and state consumer protection agencies are warning consumers not to cash them. By depositing the check, you’re agreeing to share personal information and open the door for aggressive sales tactics — or worse, identity theft. Some victims report agents showing up at their homes after cashing the check. Others say they were harassed after refusing to buy insurance.

If you deposit such a check and it clears, you may think it’s genuine, but bank employees can make mistakes, and it may take weeks to discover the check is fake after it’s processed. By then, scammers may have access to your account or other personal information.

Hallmarks of a potential check scam

- Unexpected checks: If you didn’t request it, question it.

- No contact info: A P.O. box instead of a real address or phone number is a warning sign.

- Pressure to act: Instructions that require you to provide personal details (like a phone number) before depositing.

- Promises too good to be true: “Up to $50,000 in benefits” with no clear terms? That’s a scammer’s script.

What if you receive a fraudulent check

- Don’t deposit it; instead, throw it away or shred it.

- Protect your information: Never share personal details with unknown senders.

- Report it. File a complaint with the Federal Trade Commission (FTC), the BBB, and your state’s consumer protection agency.

- Educate others. Share this alert with friends and family — especially seniors, who are often targeted.

Read the entire article: here.

Your financial journey starts with SouthEast Bank.

Olivia Johnson is marketing strategist for Southeast Bank.

Follow KnoxTNToday on Facebook and Instagram. Get all KnoxTNToday articles in one place with our Free Newsletter.