Happy New Year! It’s back to work and back to school for most of us after the holidays. Where did 2023 go? Wow, it flew by. We have closed the books on 2023 which didn’t report quite the numbers as 2022. We saw a decrease of 21.7% in the amount of money loaned last year as well as a decrease of 16.5% in the value of real estate sold.

Nick McBride

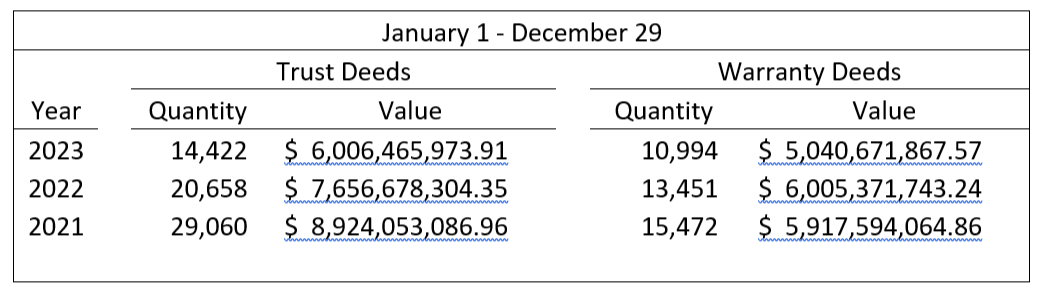

In 2023 we saw 10,994 conveyances of property compared to 13,517 in 2022. That is a decrease of 18.7%. Lending volume was no different. We saw 14,422 loans in 2023 compared to 20,730 in 2022. That is a decrease of 30.5%!

The last week of 2023 was slower than the past two years with 831 total recordings. In 2022 the weekly total was 1,027. And, not surprisingly, 1,535 documents were recorded in the last week of our record year, 2021. Property sales made up 135 of the week’s recordings and had a combined value of $75.23 million. Five commercial sales were on the million-dollar list.

The price tag on the largest commercial property sale last week came in at over $10 million. FSRE-Kerns Bakery LLC sold the former Kerns Bakery building at 2201 Kerns Rising Way, south of the Henley bridge, to FSRE-Kerns Bakery II LLC for $10.33 million.

Clayton Properties Group Inc. sold the second most expensive property to Domain Timberlake Multistate LLC. Clayton sold lots 65 thru 129 in Ivey Farms neighborhood in west Knoxville for a little over $7.06 million.

The retail center in front of Bexhill subdivision was the third most expensive on the list. Holrob-Bexhill LLC sold the new center to Fox Meadows GP for $4.55 million.

The Dollar General store located at the intersection of Heiskell Road and E. Raccoon Valley Road was also on the list. JMB Investment Company LLC sold to Heart K LLC for $1.94 million.

The last of the million-dollar properties to change hands in the last week of 2023 was the triangular-shaped property at the junction of North Broadway and Central Street. Regions Bank sold the former bank building to 707 N Broadway for $1.47 Million.

During the last week of the year 2023, lenders finalized a total of 196 loans, with a combined value of $61.34 million. This number is lower than the corresponding figures for the previous two years, with 249 loans in 2022 and 430 in 2021. Only three loans exceeded $1 million. The highest loan, valued at $3.64 million, was funded by Enrichment Federal Credit Union. Regions Bank loaned $1.12 million, and First Bank of Alabama loaned $1.10 million.

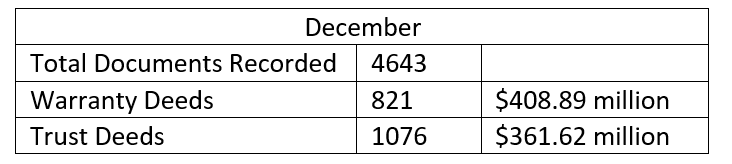

The end of the December totals:

The three-year comparison chart has been updated as of 12/29/23 and stands as the last report of the year.

A grand total of 64,728 documents were recorded in 2023. The majority were property sales and loans, but we also recorded significant numbers of both liens and lien release documents, notices of completion and corporate documents. Interest rates played a significant role in the decline in numbers for 2023, so let’s see what 2024 brings.

As the new year has arrived, take this opportunity to give yourself peace of mind for this year and the years ahead. Sign up for our FREE Property Fraud Alert Program. This program is designed to send an email alert ONLY if documents are recorded in the names you have listed. You can sign up by visiting our new website: https://rod.knoxcounty.org/

Have a great weekend! — Nick

Nick McBride is register of deeds for Knox County.